Microsoft Corporation is an American technology company. It’s headquarter is located in Redmond Washington USA. It was founded by two friends, Bill gates and Paul Allan; on April 4, 1975, in New Mexico. Microsoft operates in multiple industries which are as follow, computer hardware, computer software, digital distribution and consumer electronics. The foundation of the company was built on, developing interpreting system for Altair 8800, eventually, company became market leader in computer operating system developing industry. Unfortunately, company has lost its market share to android in operating system industry. Some of the operating systems developed by Microsoft are, Windows 7, Windows 8.1, Window xp, window8, window Vista and others. Windows 7 was a big success on the part of Microsoft, in operating system industry. 2009-2015 windows 7 seized the highest market share compare to, Microsoft other operating systems. Presently, Apple and Google are the core competitors of Microsoft in operating systems. Moreover, Microsoft Corporation operates in gaming industry, X-box and other complementary product and software related to the product is also the creation of company. 2015-2016 Microsoft bought two eminent companies LinkedIn and Skype technologies.

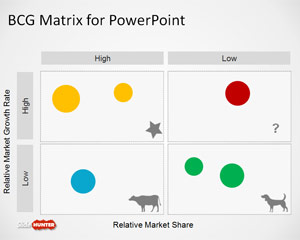

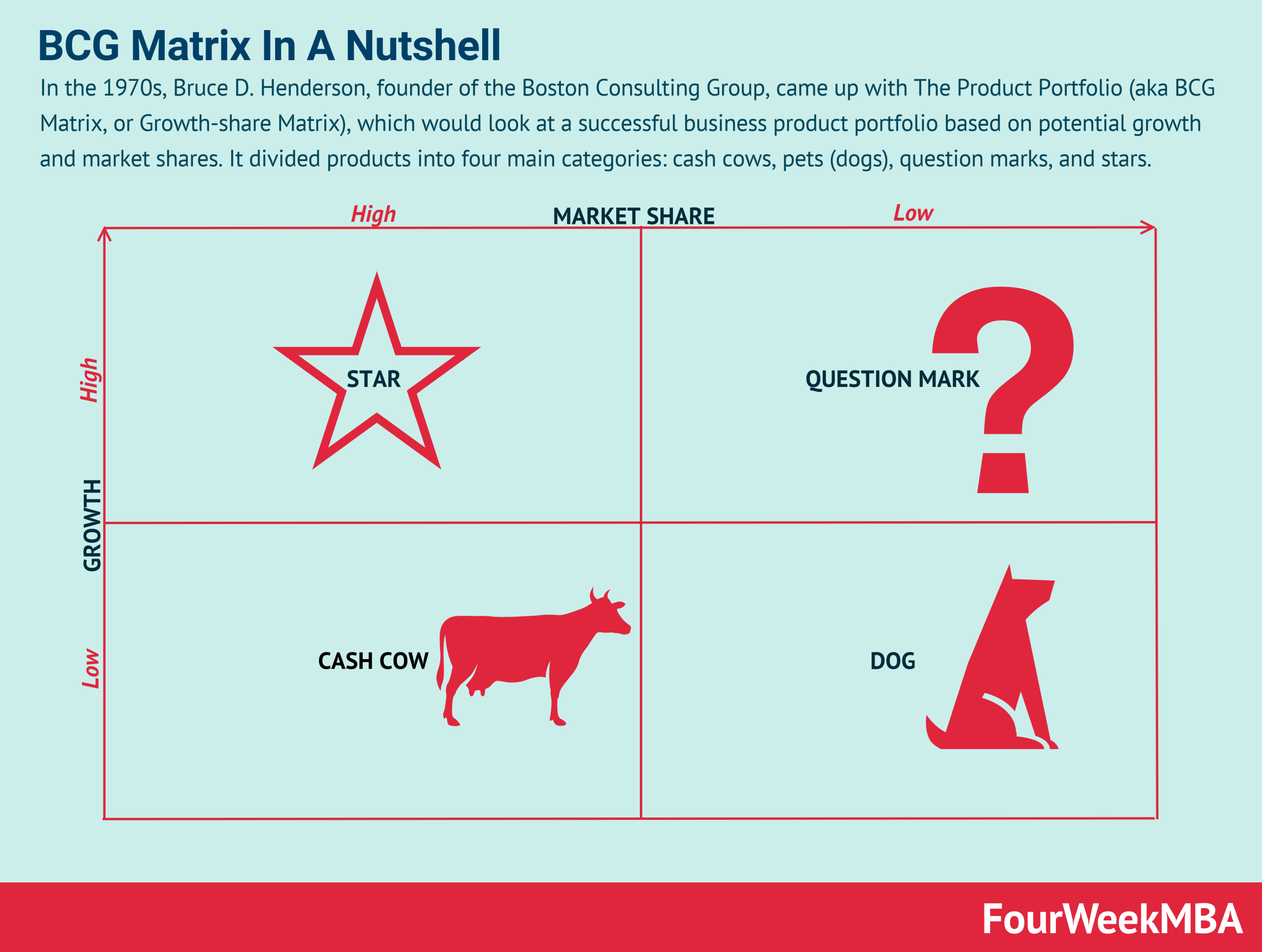

Gigantic Corporation like Microsoft is not easy to manage, as mentioned in introduction that, Corporation has multiple operating segment and each segment operates in distinct industry. For such organization formulation of strategy can be very complicated for top-level management. Therefore, to cope with the problem top-level managers use tools to formulate distinct strategy for each segment according to its needs. BSG Matrix is one of the tool which can be useful for top level manager to cope with dilemmas like, which strategy should be adopted for which segment? BCG Matrix was developed by a private consulting firm, based in Boston; “Boston consulting firm”. This matrix was specially designed for those companies which have multiple profit centers or operates in multiple industries. BCG Matrix is a four quadrants graphic representation of multiple segments, which can be analyze by means of Market share and Industry sales growth rate. Following are the categories of segments in BCG matrix; Cash cows, Dogs, Question mark and Stars. BCG matrix examination of Microsoft is given below.

Question Mark

Those segments are included into the category of Question mark which have low relative market share and operate in high sales growth industry. Microsoft Phone hardware segment comes into the category of question mark, following products are manufactured by Microsoft in mentioned segment; Lumia and non-Lumia phones. When android phones were introduced most of the customers of windows cell phone switched to android which almost occupied the market share of Microsoft Lumia. In the current scenario Microsoft should use product development strategy to increase its market share and turn this segment into star.

Bcg Matrix Of Microsoft Company Background Design

Stars

Get Free BCG Matrix Templates in Microsoft Word And Excel Format Person who are working in an organization especially doing job in HR dept are familiar to this management template. Basically BCG stands fo. Bcg Matrix Of Microsoft Company Info Nach Baliye 6 11th January 2014 Full Episode Check out my Blog: If you've taken business class or familiar with management consulting strategies, you've probably come across this tool called a BCG Matrix. Description: Download editabletemplates.com's premium and cost-effective BCG Matrix PowerPoint Presentation Templates now for your upcoming PowerPoint presentations. Be effective with all your PowerPoint presentations by simply putting your content in our BCG Matrix professional PowerPoint templates, which are very economical and available in, orange, yellow, green, blu colors.

Stars are those segments which have high market share and compete in high sales growth industry. Device and consumer segment of Microsoft Corporation, can be counted amongst the stars segments. Windows Operating systems and word processor (MS office), Mobile application and windows related software products and services are included in the mentioned segment. Apple and Google are the competition of Microsoft in D&C segment. Market development and product development strategies are suggested for stars segment according to BSG matrix.

Cash Cows

Microsoft computing and Gaming segment can be included into cash cow category. Cash cows are those segments, which operates in low sales growth industry but have high market share. Such segments are viable for companies to sustain its financial position for long term. Xbox one and Xbox 360 holds a big chunk of market share in gaming industry but yet Sony is the market leader in video game industry. Horizontal integration can help the corporation to grab largest market share in the industry. Microsoft computing and Gaming segment comprise of the following products and services, consoles of gaming and entertainment, royalties of second and third party video games, live subscription of Xbox platform devices and accessories, accessories of Microsoft PC.

Bcg Matrix Of Microsoft Company Background Template

Dogs

It is fortunate for Microsoft that, none of its segment fall into the category of dogs. Dogs are those segments which compete in low sales growth industry and have low relative market share. Such segments are liability on the organization. Liquidation strategy is suggested by BCG matrix for such segments.

References

MICROSOFT CORPORATION (MSFT). Retrieved from.

http://csimarket.com/stocks/competitionSEG2.php?code=MSFT

Annual report 2015. Retrieved from.

https://www.microsoft.com/investor/reports/ar15/index.html

Global unit sales of current generation video game consoles from 2008 to 2016 (in million units). Retrieved from.

https://www.statista.com/statistics/276768/global-unit-sales-of-video-game-consoles/

Desktop Operating System Market Share. Retrieved from.

https://www.netmarketshare.com/operating-system-market-share.aspx?qprid=10&qpcustomd=0

.

The BCG Model is based on the product life cycle theory that can be used to determine what priorities should be given in the product portfolio of a business unit. To ensure long-term value creation, a company should have a portfolio of products that contains both high-growth products in need of cash inputs and low-growth products that generate a lot of cash. It has 2 dimensions: market share and market growth. The basic idea behind it is that the bigger the market share a product has or the faster the product's market grows the better it is for the company.

Placing products in the BCG matrix results in 4 categories in a portfolio of a company:

1. Stars (=high growth, high market share)

- use large amounts of cash and are leaders in the business so they should also generate large amounts of cash.

- frequently roughly in balance on net cash flow. However if needed any attempt should be made to hold share, because the rewards will be a cash cow if market share is kept.

2. Cash Cows (=low growth, high market share)

- profits and cash generation should be high , and because of the low growth, investments needed should be low. Keep profits high

- Foundation of a company

3. Dogs (=low growth, low market share)

- avoid and minimize the number of dogs in a company.

- beware of expensive ‘turn around plans’.

- deliver cash, otherwise liquidate

4. Question Marks (= high growth, low market share)

- have the worst cash characteristics of all, because high demands and low returns due to low market share

- if nothing is done to change the market share, question marks will simply absorb great amounts of cash and later, as the growth stops, a dog.

- either invest heavily or sell off or invest nothing and generate whatever cash it can. Increase market share or deliver cash

The BCG Method can help understand a frequently made strategy mistake: having a one-size-fits-all-approach to strategy, such as a generic growth target (9 percent per year) or a generic return on capital of say 9,5% for an entire corporation.

In such a scenario:

A. Cash Cows Business Units will beat their profit target easily; their management have an easy job and are often praised anyhow. Even worse, they are often allowed to reinvest substantial cash amounts in their businesses which are mature and not growing anymore.

B. Dogs Business Units fight an impossible battle and, even worse, investments are made now and then in hopeless attempts to 'turn the business around'.

C. As a result (all) Question Marks and Stars Business Units get mediocre size investment funds. In this way they are unable to ever become cash cows. These inadequate invested sums of money are a waste of money. Either these SBUs should receive enough investment funds to enable them to achieve a real market dominance and become a cash cow (or star), or otherwise companies are advised to disinvest and try to get whatever possible cash out of the question marks that were not selected.

Some limitations of the Boston Consulting Group Matrix include:

High market share is not the only success factor

Market growth is not the only indicator for attractiveness of a market

Sometimes Dogs can earn even more cash as Cash Cows

Book: Carl W. Stern, George Stalk - Perspectives on Strategy from The Boston Consulting Group

T I P : Here you can discuss and learn a lot more about the BCG Matrix.

Compare with the BCG Matrix: GE / McKinsey Matrix | ADL Matrix | Core Competence | Bass Diffusion model | Relative Value of Growth | STRATPORT | Profit Pools | Product Life Cycle | Blue Ocean Strategy | Four Trajectories of Industry Change | Positioning